The Labor Code of the Russian Federation obliges employers to keep records of the time worked by employees (Article 91 of the Labor Code of the Russian Federation). The unified form T-13 “Working time sheet” is provided precisely for this (approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1). It reflects information about employees’ attendance and absence (for various reasons) at work, as well as the amount of time they actually worked. Thanks to the time sheet, the employer can track the employee’s compliance with the established working hours.

If most of the employees work under the same working hours, then the organization’s personnel service (or accounting department) can maintain a single time sheet for all employees. If the company’s divisions operate in different modes, then each of them can maintain its own accounting sheet. This is done by an authorized person, and then transfers the information to the human resources department and/or accounting department. Wages to employees must be calculated taking into account the data specified in the timesheet.

Please note that the use of Form T-13 by commercial organizations is not mandatory. The company can develop its own form, but it must be approved by the head (Letter of Rostrud dated 02/14/2013 N PG/1487-6-1, Part 4 Article 9 of the Law dated 12/06/2011 N 402-FZ).

Filling out form T-13

Form T-13 can be filled out in two ways: either it records all employee appearances and absences using the continuous registration method, or only deviations from the generally established work schedule are indicated (no-shows, overtime, etc.). For this purpose, special codes are used (Instructions for recording working time and settlements with personnel for wages, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1).

In column 4 of the timesheet, 2 cells are allocated for each date of the month: in the upper one a code indicating the employee’s attendance or absence is entered, in the lower one - the amount of time he worked on that day. If the employee was absent from work (on vacation, business trip, etc.), then the bottom cell is left empty.

Symbols - codes - are given on the title page of form N T-12. They come in two types: alphabetic and numeric. The employer can use one or the other at its discretion. For example, the duration of work during the day is indicated by the code “I” or “01”, the annual main paid leave is indicated by the code “FROM” or “09”, and a business trip is indicated by the code “K” or “06”.

If, in addition to information about attendance and work time, in the opinion of the employer, it is necessary to indicate other information in the form, then additional lines may be added to the timesheet.

Time sheet 2019 download form in excel for free T-12, T-13

08.01.2019

Unified forms of report card No. T-12 "Record sheet working hours and calculation of wages" and No. T-13 " Time sheet"approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment.” They are unified forms of primary accounting documentation for recording labor and its payment (for recording working hours and settlements with personnel for wages).

Commencement of the resolution: 04/03/2004.

Government institutions (state-owned, budgetary, autonomous) use the report card form according to OKUD 0504421 ""Tablet for recording the use of working time" approved by order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local government bodies, management bodies of state extra-budgetary funds, state (municipal) institutions, and Guidelines for their application", as amended Order of the Ministry of Finance of Russia dated November 16, 2016 No. 209n and dated November 17, 2017 No. 194n.

Regarding forms T-12 and T-13 (continued):

According to information from the Ministry of Finance of the Russian Federation No. PZ-10/2012from 01/01/2013, the forms of primary accounting documents contained in albums of unified forms of primary accounting documentation are not mandatory for use. At the same time, forms of documents used as primary accounting documents established by authorized bodies in accordance with and on the basis of other federal laws (for example, cash documents) continue to be mandatory for use.

Time sheet working hours and wage calculation(Form N T-12)

Time sheet(form N T-13)

They are used to record the time actually worked and (or) not worked by each employee of the organization, to monitor employees’ compliance with the established working hours, to obtain data on hours worked, calculate wages, and also to compile statistical reporting on labor. When keeping separate records of working hours and settlements with personnel for wages, it is allowed to use section 1 “Accounting for working hours” of the timesheet in Form N T-12 as an independent document without filling out section 2 “Settlements with personnel for wages”. Form N T-13 is used to record working hours.

They are drawn up in one copy by an authorized person, signed by the head of the structural unit, an employee of the personnel department, and transferred to the accounting department.

Notes in the report card on the reasons for absence from work, work part-time or outside the normal working hours at the initiative of the employee or employer, reduced working hours, etc. are made on the basis of documents prepared properly (certificate of incapacity for work, certificate of performance state or public duties, written warning about downtime, application for part-time work, written consent of the employee to work overtime in cases established by law, etc.).

To reflect the daily working time spent per month for each employee, the timesheet is allocated:

in form N T-12 (columns 4, 6) - two lines;

in form N T-13 (column 4) - four lines (two for each half of the month) and the corresponding number of columns (15 and 16).

In forms N T-12 and N T-13 (in columns 4, 6), the top line is used to mark the symbols (codes) of working time costs, and the bottom line is used to record the duration of worked or unworked time (in hours, minutes) according to the corresponding working time cost codes for each date. If necessary, it is allowed to increase the number of boxes to enter additional details according to the working hours, for example, the start and end times of work in conditions other than normal.

When filling out columns 5 and 7 of the timesheet according to Form N T-12, the number of days worked is entered in the top lines, and the number of hours worked by each employee during the accounting period is entered in the bottom lines.

Working time costs are taken into account in the Timesheet either by completely recording appearances and absences from work, or by registering only deviations (absences, tardiness, overtime, etc.). When reflecting absences from work, which are recorded in days (vacation, days of temporary disability, business trips, leave in connection with training, time spent performing state or public duties, etc.), only codes are entered in the top line in the columns of the Timesheet symbols, and the columns in the bottom line remain empty.

When compiling a timesheet in Form N T-12 in Section 2, columns 18 - 22 are filled in for one type of payment and corresponding account for all employees, and when calculating different types of payment and corresponding accounts for each employee, columns 18 - 34 are filled in.

Form N T-13 “Working time sheet” is used for automated processing of accounting data. When drawing up a report card in form N T-13:

when recording accounting data for payroll for only one type of payment and a corresponding account common to all employees included in the Timesheet, fill in the details “type of payment code”, “corresponding account” above the table with columns 7 - 9 and column 9 without filling out columns 7 and 8;

when recording accounting data for payroll for several (from two to four) types of payment and corresponding accounts, columns 7 - 9 are filled in. An additional block with identical column numbers is provided for filling out data by types of payment, if their number exceeds four.

Form N T-13 report cards with partially filled in details can be produced using computer technology. Such details include: structural unit, last name, first name, patronymic, position (specialty, profession), personnel number, etc. - that is, data contained in directories of conditionally permanent information of the organization. In this case, the form of the report card changes in accordance with the accepted technology for processing accounting data.

The symbols of worked and unworked time presented on the title page of Form N T-12 are also used when filling out the time sheet in Form N T-13.

A time sheet is the main document containing information about the number of appearances and absences for work of each employee of the company. It is transferred to the accounting department. And based on the data, wages are calculated and calculated.

The law provides for 2 unified report forms: T-12 – for filling out manually; T-13 – for automatic control of actually worked time (via a turnstile).

Data is entered every working day. At the end of the month, the total of attendances and absences of each employee is calculated. Report generation can be simplified by automating the filling of some cells using Excel. Let's see how.

Filling in input data with Excel functions

Forms T-12 and T-13 have almost the same composition of details.

Download the time sheet:

In the header of page 2 of the form (using T-13 as an example), fill in the name of the organization and structural unit. Just like in the constituent documents.

We enter the document number manually. In the “Date of Compilation” column, set the TODAY function. To do this, select a cell. Find the one you need in the list of functions and click OK twice.

In the “Reporting period” column, indicate the first and last day of the reporting month.

We allocate a field outside the timesheet. This is where we will work. This is the OPERATOR field. First, let's make our own calendar for the reporting month.

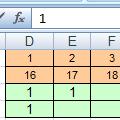

Red field – dates. On the green field he puts down ones if the day is a day off. In cell T2 we put one if the timesheet is compiled for a full month.

Now let's determine how many working days there are in a month. We do this on the operational field. Insert the formula =COUNTIF(D3:R4;"") into the desired cell. The COUNTIF function counts the number of non-blank cells in the range specified in parentheses.

We manually enter the serial number, full name and specialty of the organization’s employees. Plus a personnel number. We take information from employees’ personal cards.

Timesheet automation using formulas

The first sheet of the form contains symbols for recording working time, digital and alphabetic. The point of automation using Excel is that when entering a designation, the number of hours is displayed.

For example, let's take the following options:

- On a weekend;

- I – attendance (working day);

- OT – vacation;

- K – business trip;

- B – sick leave.

First, let's use the Select function. It will allow you to set the desired value in the cell. At this stage, we will need the calendar that was compiled in the Operator Field. If a day falls on a day off, “B” appears on the timesheet. Worker – “I”. Example: =CHOICE(D$3+1,"I","B"). It is enough to enter the formula in one cell. Then “hook” it to the lower right corner and move it along the entire line. It turns out like this:

Now we’ll make sure that people have “eights” on turnout days. Let's use the "If" function. Select the first cell in the row under the legend. “Insert function” – “If”. Function arguments: logical expression – address of the cell being converted (cell above) = “B”. "If true" - "" or "0". If this day is truly a day off – 0 working hours. “If false” – 8 (without quotes). Example: =IF(AW24="B";"";8). “Catch” the lower right corner of the cell with the formula and multiply it throughout the entire row. It turns out like this:

You need to do the same work for the second half of the month. It is enough to copy the formulas and change the cells they refer to. Result:

Now let’s summarize: count the number of appearances of each employee. The “COUNTIF” formula will help. The range for analysis is the entire series for which we want to get the result. The criterion is the presence in the cells of the letter “I” (appearance) or “K” (business trip). Example: . As a result, we get the number of working days for a particular employee.

Let's calculate the number of working hours. There are two ways. Using the “Sum” function - simple, but not effective enough. More complicated, but more reliable - by using the “COUNTIF” function. Example formula: . Where AW25:DA25 is the range, the first and last cells of the row with the number of hours. The criterion for the working day (“I”) is “=8”. For a business trip – “=K” (in our example, 10 hours are paid). The result after introducing the formula.

Each company and entrepreneur acting as an employer, when using the labor of employees, must take into account their working hours. The legislation provides for the use of a special form for these purposes, called a working time sheet. The responsibility for filling it out lies with the responsible officials.

The Labor Code of the Russian Federation establishes that every employer, regardless of its form of ownership, must keep records of the hours worked by its employees. For the lack of timesheets, administrative penalties are provided for both the organization itself and its responsible employees.

A time sheet is a form that contains information about working days for each employee, as well as absences from work for good or bad reasons. It can be done in two ways:

- All data on the presence or absence of employees is maintained daily.

- Data is entered into the timesheet in case of deviation, i.e. in case of absence, no-show, lateness, etc.

Based on the information in this document, salaries are calculated for all company personnel. It allows you to monitor compliance with labor discipline, as well as the standard length of the working week, duration, and performance of duties on weekends.

The legislation establishes a 40-hour week for a five-day job, and a 36-hour week for a six-day job. With summarized accounting, the norm may be violated; the main requirement is that it correspond to a certain amount for the reporting period, for example, a quarter.

When a company receives an inspection from the labor inspectorate, the main document they request is a work time sheet. It is also the main source for generating statistical reporting on labor and personnel.

Procedure for using the report card

Timesheets are assigned to a specific employee, who is controlled by the head of his structural unit. Entries in the report card are made every day.

Timesheets are assigned to a specific employee, who is controlled by the head of his structural unit. Entries in the report card are made every day.

According to the norms of the law, a business entity has the right to use a form in form T-12 or form T-13, approved by Rosstat. The first option is used both for accounting for the period of work and for calculating wages. The second document can be used if working time is reflected automatically.

The company can also develop its own document taking into account existing needs. At the same time, it must contain a number of mandatory details. Personnel accounting programs contain unified forms.

Filling out the timesheet can be done manually or using a computer. In the latter case, all information is entered into the program, and the form itself is printed at the end of the month.

In this case, special designations are used in the report card. They are alphabetic and numeric. For example, an employee’s work within the normal range is reflected by the letter Y or code 01. The document is entered first with the code, and then with the duration of work. Ciphers cannot be used just like that; they must be filled out on the basis of supporting documents or otherwise.

The timesheet reflects all the time, including business trips, vacations, sick leave, etc. You can enter the code for the type of remuneration in the timesheet, which is a four-digit digital code. For example, code 2000 is used for salaries, 2010 for civil contracts, 2012 for vacation and compensation, 2300 for sick leave, etc.

The timesheet is closed on the last day of the month or the next day. The responsible person submits it to the head of the department for verification and signature, and then forwards it to the personnel department. The personnel service checks the information from the provided timesheet with documents on personnel. After this, the time sheet is sent to the accounting department for salary calculation.

It should be taken into account that the time sheet must be provided in two parts, of which the first half of the month is provided for calculating an advance salary, and the second half for calculating the full salary based on the results of the month worked.

The spent document is filed in special folders, and at the end of the year it is sent to the archive, where it can be stored for up to five years. If the company, in accordance with a special assessment, has harmful and dangerous working conditions, this form must be retained for up to 75 years.

Sample time sheet

Please note that for convenience and better information content of the example, we have slightly modified the timesheet - some lines have been removed and some have been added, but the general meaning has not been changed. At the end of the page you can download sample timesheets in Excel format.

You need to start filling out from the header of the document. Here the full name of the company and its code according to the OKPO directory are indicated, on the next line - for which structural unit this report card is being compiled.

Then the serial number of the document, the date of preparation, as well as the period it covers (usually a calendar month) are recorded.

After this, the main part of the document is filled out.

After this, the main part of the document is filled out.

Column 1 - number in line order in this table

Columns 2 and 3 - Full name. employee, his position, assigned personnel number.

Column 4 is used to record the employee’s attendance or absence on a daily basis. For each day, two cells are allocated, one below the other - the top one contains a code designation, usually in the form of a letter or number, the bottom one contains the number of hours worked, or it can be left empty.

Basic codes for filling in attendance:

- I – if the employee has worked a full working day.

- K – if the employee is on a business trip.

- B – this code marks weekends and holidays.

- OT – when the employee is on basic annual paid leave.

- B – In case of employee illness (sick leave) or temporary disability.

- BEFORE - if the employee took leave without pay (at his own expense).

- P – leave provided to an employee on the occasion of pregnancy and childbirth.

- OZH – leave to care for a child under 3 years of age.

- NN - in the event of an employee’s failure to show up at the workplace for unknown reasons. You can either leave an empty space or indicate this code until the reason for absence is clarified; if they are valid, then you will need to enter a code corresponding to the reason.

Column 5 indicates how many days and hours were worked out for each half of the month - days on top, hours on bottom.

Column 6 indicates the same data, but for the whole month.

Columns 7-9 are used to indicate information intended for salary calculation. If all employees included in the timesheet use the same wage code and corresponding account, then in the header of this table you need to fill in the corresponding columns of the same name. In this case, columns 7-8 directly in the employee’s line remain empty, and you only need to indicate data in column 9.

Columns 7-9 are used to indicate information intended for salary calculation. If all employees included in the timesheet use the same wage code and corresponding account, then in the header of this table you need to fill in the corresponding columns of the same name. In this case, columns 7-8 directly in the employee’s line remain empty, and you only need to indicate data in column 9.

If during the month the codes and accounts of employees differ, then in column 7 the digital code corresponding to the required type of remuneration is indicated. Following this, in column 8 you need to enter the account number according to the Chart of Accounts, which corresponds to this type of payment. Column 9 indicates the number of days or hours that were worked according to the recorded type of payment.

Basic wage codes:

- 2000 – when paying wages under standard employment contracts and travel allowances.

- 2010 – in case of payment for labor under civil contracts.

- 2012 – if the employee is paid vacation pay.

- 2300 – when paying sick leave and temporary disability benefits.

In columns 10-13, information about the employee’s absence from the workplace is entered - here you need to indicate the code corresponding to the reason, as well as how many days or hours it applies to.

At the bottom of the timesheet on the left is the surname, position and personal signature of the person who filled it out. Opposite him on the right, the document is signed by the head of the department for which the report card was drawn up and the employee of the personnel department indicating their data. The date of signing by each of the responsible persons is indicated here.

At the bottom of the timesheet on the left is the surname, position and personal signature of the person who filled it out. Opposite him on the right, the document is signed by the head of the department for which the report card was drawn up and the employee of the personnel department indicating their data. The date of signing by each of the responsible persons is indicated here.

Nuances

An additional sheet may be added to the main timesheet, which must be filled out for the employee upon his dismissal. At the end of the month, it is attached to the general time sheet, in which an entry is made for the retired employee “Dismissed”.

Employee absence from work

If an employee does not show up for work for an unknown reason, then in column 4 of the timesheet you need to enter the code “NN” or “30” - “Absence for unknown reasons.” After the employee confirms the reason for absence - sick leave, absenteeism, etc., corrections are made to the time sheet and the “NN” code is changed to the one corresponding to the reason for absence.

Illness while on vacation

If an employee fell ill while on annual leave and upon returning from it brought sick leave, in this case the indicated days of illness in the report card are marked with code (B) instead of the marked days of vacation (OT). In this case, the leave will be extended for the duration of the employee’s illness.

Celebration during vacation

If, in accordance with the production calendar, holidays fall during the vacation period, for example the May holiday, then these days are not included in the vacation - code (B) should be entered instead. The remaining days are also marked with the corresponding code (OT). So, for example, a vacation can fall on Russia Day if it is taken from June 11 to June 18. In this case, June 13 is marked with code (B).

To record the time actually worked by employees in the organization, labor legislation provides for filling out a working time sheet. This obligation also applies to private entrepreneurs and legal entities of any form of organization.

In order to organize the accounting process, Goskomstat developed and approved special accounting forms No. T-12 and No. T-13.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Maintaining a timesheet is a simple procedure, but implementation requires compliance with certain rules on how data should be reflected, because calculations for wages of employees depend on the correct execution of the report. In addition, accounting will allow the organization to avoid additional costs for paying for actually unprocessed time.

What is this document and what is it for?

By Decree of the State Statistics Committee No. 1 of January 5, 2004, a special form was approved, which is administered by the personnel department and accounting department.

This form allows you to do the following:

- keep records of hours worked, as well as reflect information about hours not worked by the employee;

- monitor compliance with work discipline, reflect attendance/absence, facts of being late for work;

- have sufficient information about the amount of work performed by the employee in order to further correctly calculate wages and enter information for statistics.

Forms No. T-12 and T-13 serve as the basis for the accountant to accrue wages and additional compensation to each employee. For the HR department, the report card will allow you to monitor the attendance of employees, and if violations are detected, impose penalties on the offending employee.

Tax legislation provides for the right of an employee upon dismissal to request a time sheet along with the issuance of other personal documents, including a work book. This provision is enshrined in Art. 84.1 NK.

Enterprise managers should be aware that since 2013, unified forms have been abolished. Despite the abolition of strictly established forms, the obligation to keep records of employees’ work time in the organization remains in accordance with Part 4 of Art. 91 TK. Thus, the enterprise has the opportunity to make adjustments to the design of the document for recording the time worked by employees.

Since the form introduced by Goskomstat is convenient for entering data and further processing, many organizations continue to use it.

If wages are calculated separately, the second section of the T-12 form is left blank.

Who is responsible for maintaining the document?

According to the Instructions for the use and completion of primary accounting documentation in force in 2019, the forms are prepared by a separate employee who has been assigned this action. The document must bear the certifying signature of the manager and the personnel officer.

A separate position for accounting at the enterprise is not required; this work can be performed by any employee who is given authority to do so by management. This occurs by issuing an order appointing an employee of an established position responsible for recording work time.

In addition, it will be necessary to introduce a separate clause into the employment contract on granting such powers to the employee. If this is not done, management does not have the right to demand that the employee perform accounting duties.

The appointed official enters the data within a month, and then submits the document to the head of the department and the employee of the personnel department for signing. The personnel officer checks the data, takes the information necessary to perform personnel work from the provided report, then signs the form and passes it on to the accounting department for further work.

If the organization is not large, time tracking is made the responsibility of a personnel employee, who then gives the document to the accountant to calculate wages.

Sample of filling out form T-13:

Rules for filling out a time sheet

The productivity of the accountant and HR officer will depend on how convenient it is to work with the report, and the correct reflection of information about the time actually spent at the workplace will make it possible to make correct calculations of payment to the employee, which is beneficial to both parties - the employee and his employer.

On the one hand, the employer has the right to make a deduction if the actual time worked does not correspond to the time established in the contract. On the other hand, a watchman who went to work on a day off has the right to demand additional compensation for the amount of work performed.

The document is an act on the work actually performed by each employee and on the working regime in force at the enterprise, recording any deviations from the established work schedule.

The timesheet is required for the operation of the following organizational structures:

Following simple rules, an employee can quickly and competently draw up a report on the time actually worked by the company’s employees during the month:

- The report card is filled out in a single copy.

- You can fill out the sample form manually, or enter information via a computer.

- In order for an employee to have the right to carry out accounting, the head of the enterprise must issue an appropriate order to vest the employee with the necessary powers. This responsibility should be included in the job description.

- Preparation of the timesheet begins on the eve of the reporting month.

- The title page contains information about the full name of the enterprise, division, as well as the start date of accounting. At the end of the month and the timesheet is closed, the end date of the report is entered.

- The following sheet is designed in the form of a table with information about employees filled out. It is necessary to ensure that the surnames and first names of employees are correctly indicated, avoiding the possibility of confusion among employees with the same surname.

- For each employee, information about his personal file number is entered.

- Each column of the timesheet corresponds to a specific day of the month.

- The cells opposite the names contain information about the hours worked, the number of shifts, and if there are weekends and holidays, the corresponding marks are entered.

- Information about the work actually performed is entered every day, based on the official documents provided (sick leave certificates, orders, statements, management orders).

- Cases of tardiness and absenteeism are also subject to reflection in the form of letter and numeric codes.

The document is considered valid if it is signed by the authorities. Responsibility for the correct entry of information rests entirely with the designated employee.

Features for budget organizations

In enterprises operating on a budget, a different form of accounting has been introduced, approved in the form of form No. 0504421. The form differs from the general forms T-12 and T-13, due to the reflection of the specifics of the work of state employees. New codes are introduced in the table to be filled out: study days off, replacement in extended day groups, study leaves.

The title and tabular parts have some differences:

- the title page, in addition to information about the name of the organization, contains a digital code;

- if there are no changes, the column is marked “0”;

- if adjustments were made, the serial number of the changes is indicated;

- columns 20, 37 contain information on intermediate and monthly totals of working time;

- no additional calculations are made in the form.

Otherwise, the rules for filling out this form differ little from the standardized forms.

Sample of filling out form T-12:

Sample forms T12 and T13

Using the sample, you can quickly and correctly enter information, which will then be easily read and used by the HR department and accounting department.

Filling out a working time sheet according to the sample involves the use of digital and alphabetic designations, with a mandatory decoding on the title page of the report. Since in some cases the established codes are not enough, management should issue a separate order approving additional designations (for example, breaks for breastfeeding).

The main code designations introduced by Goskomstat No. 20 dated March 24, 1999 are the following:

| Index | Alphanumeric code |

| Duration of daily work | Me (01) |

| Work at night | N (02) |

| Work on holidays and weekends | RV (03) |

| Overtime work | C (04) |

| Business trip | K (06) |

| Paid leave according to Labor Code | OT (09) |

| Additional leave (paid) | OD (10) |

| Leave due to pregnancy and childbirth | R (14) |

| Child care up to 3 years old | Coolant (15) |

| Additional leave at your own expense | DB (18) |

| Sick leave (paid) | B (19) |

| Disability without payment of benefits | T (20) |

When checking the sample filling, you should pay attention to the most common errors when filling out:

- Only the last name with initials is entered, without position;

- indicating a holiday non-working day as a working day;

- indicating the duration of the pre-holiday day as full (“8” instead of “7”).

When recording the work of a part-time worker, the exact duration of work must be noted. The hours and minutes spent by such an employee on performing his duties are indicated in the bottom line in columns 4, 6 (on form T-12) or the 2nd and 4th line in column 4 (on form T-13). In case of internal part-time work, the duration of work is distributed according to positions.

If an employee is on a business trip, the letter code “K” or the numeric code “06” is entered on the time sheet without indicating the hours of work.

Penalties for incorrect handling

Proper execution of the report card is controlled by supervisory government agencies. If violations are detected during any of the audits (financial or tax), the organization will be punished.

The most frequently identified inconsistencies are:

- there is a discrepancy between the data in the accounting sheet and the primary reporting;

- salary data does not correspond to calculations in payment documents;

- codes were entered with errors, incorrect codes were used without taking into account overtime and overtime;

- Incorrect calculation of sick leave benefits.

If a violation is established, the company may be fined up to 5 thousand rubles. A much more serious punishment awaits if the mandatory time sheet was not kept at all. The amount of the fine can be up to 50 thousand rubles, levied on the managerial person on the basis of Art. 5.27 Code of Administrative Offences.