Business entities attract hired personnel on the basis of employment agreements, which provide for the payment of a certain amount of remuneration to those working in the company for their work. The processes for calculating and issuing such amounts must necessarily be reflected in accounting. For these purposes, postings for wages and taxes are used.

Establishes the following accounts through which wages are calculated and paid to employees working in the company under employment contracts:

- Accounts for recording costs by place of their occurrence - 08, 20,23,25,26,28,29,44, 86, 91, 96, 99 - are used to pay salaries to company employees employed in various structural divisions of the company.

- Account 50 – to reflect the payment of wages from the company’s cash desk.

- Account 51 - to reflect the transfer of remuneration to employees to their bank accounts.

- Account 68 “Personal Income Tax” – is used when the employer fulfills the duties of a tax agent to withhold and transfer wages.

- Account 69 - used to calculate benefits included in the employee’s salary, but paid from social insurance funds; this account is also used when a company, within the framework of compulsory social insurance, accrues wage contributions to the Pension Fund of the Russian Federation, the Compulsory Medical Insurance Fund, and the Social Insurance Fund.

- – used when calculating and issuing earnings to employees. This account collects information about payroll settlements with the employee.

- Account 73 - applies when there are other relationships with the employee that involve deductions from his salary. First of all, this is the return of loans provided, compensation for damage caused to the organization, calculation of compensation for the use of personal transport, etc.

- - applies in the case of withholding on writs of execution received by the company in favor of third writs, as well as on the basis of a voluntary application by the employee. Salary deposits are also reflected in this account.

- Account 84 - is used when calculating amounts due to an employee, the source of which is the company’s profit.

Payroll postings

Wages are accrued, posting in the table:

| Debit | Credit | Operation designation |

| 08 | 70 | Earnings accrued to employees upon creation or acquisition of non-current assets |

| 70 | Earnings have been accrued to the main employees of the company. | |

| 23 | 70 | Earnings have been accrued to auxiliary employees of the enterprise. |

| 25 | 70 | Earnings were accrued to the general shop workers of the organization. |

| 26 | 70 | Earnings were accrued to administrative and managerial employees. |

| 29 | 70 | Earnings accrued to service personnel. |

| 44 | 70 | Earnings accrued to employees when selling goods |

| 91 | 70 | Earnings have been accrued to employees involved in the disposal of fixed assets and materials. |

| 20, 96 | 70 | Vacation pay was accrued to company employees (without creating a reserve and with creating a reserve for upcoming payments). |

| 20 | 70 | Compensation was accrued for unused rest time and severance pay upon dismissal |

| 69 | 70 | Sickness certificate benefits have been accrued. |

| 84 | 70 | Financial assistance and bonus from company profits were awarded |

| 84 | 70 | Dividends are accrued to a company member when he is an employee of the company |

| 97 | 70 | Earnings to employees are accrued from future expenses. |

| 99 | 70 | Earnings have been accrued to employees involved in the liquidation of emergency consequences. |

Postings in a budget institution

Budgetary institutions have a different Chart of Accounts than commercial enterprises.

The table presented below contains transactions for the calculation and issuance of salaries in budgetary organizations.

| Debit | Credit | Operation designation |

| 040120211 | 030211730 | Earnings accrued to employees of budgetary organizations |

| 030211830 | 030301730 | Personal income tax withheld from salary |

| 030211830 | 020134610 | Salaries were issued in cash from the organization's cash desk |

| 040120213 | 030310730 | Contributions to the Pension Fund have been accrued |

| 040120213 | 030302730 | Contributions to the Social Insurance Fund have been accrued |

| 040120213 | 030307730 | Contributions to the Compulsory Medical Insurance Fund have been accrued |

| 040120213 | 030306730 | Contributions from the National Tax Service at work have been accrued |

| 030211830 | 030402730 | Salary that was not paid on time was deposited |

| 030211830 | 020111610 | Salaries were transferred to employee card accounts |

| 030211830 | 030403730 | Deductions were made according to the writ of execution |

| 030302830 | 030213730 | Sick leave benefits have been accrued (at the expense of the Social Insurance Fund). |

| 040120213 | 030213730 | The benefit was accrued at the expense of the budget organization (3 days). |

You might be interested in:

UIN in a payment order: what is it, where can I get it from 2019

Tax payment transactions

Personal income tax must be withheld from the employee's salary. In addition, contributions to social funds and injuries are assessed for the entire amount of earnings.

Contributions are accrued to the same cost accounts as the employee’s salary. Transfer of such obligatory payments occurs only by non-cash method within the time limits established by law.

| Debit | Credit | Operation designation |

| 70 | 68 | Personal income tax has been removed from earnings |

| 73 | 68 | Personal income tax is withheld from material assistance (if its amount is more than 4,000 rubles) |

| 68 | 51 | The tax was transferred to the budget |

| 20, 23, 25, 26 | 69/PF | Contributions to the pension fund have been accrued |

| 20, 23, 25, 26 | 69/SOC | Social security contributions accrued |

| 20, 23, 25, 26 | 69/MED | Health insurance premiums accrued |

| 20, 23, 25, 26 | 69/TRAUMA | Contributions to the Social Insurance Fund for injuries have been accrued |

| 69/PF | 51 | Contributions to the pension fund have been transferred |

| 69/SOC | 51 | Social security contributions transferred |

| 69/MED | 51 | Medical insurance contributions listed |

| 69/TRAUMA | 51 | Contributions to the Social Insurance Fund for injuries have been paid |

Examples of accounting entries

Let's look at the accounting entries for wages, examples in the table.

Paying salaries on time

Salaries can be paid from the organization's cash desk, or by non-cash transfer to a card or bank account.

Payment deposited

If salaries are paid to employees in cash, there is a deadline for payment specified by law. If, upon completion, there are unpaid amounts left in the cash register, then such salary is subject to deposit, i.e., returned to the current account. It must be issued upon request.

| Debit | Credit | Operation designation |

| 50/1 | 51 | Money was received from the current account to the cash desk for salary payments |

| 70 | 50/1 | Part of the salary was paid to employees |

| 70 | 76/4 | Wages deposited and not paid on time |

| 51 | 50/1 | The money was returned back to the bank account |

| 76/4 | 50/1 | The deposited salary was issued at the request of the employee |

| 76/4 | 68 | |

| 68 | 51 | Personal income tax transferred to the budget |

| 76/4 | 90/1 | Unclaimed wages are written off as other income |

Paying salaries to a bank card (salary project)

The peculiarity of accounting for the payment of wages lies in the way it is processed by the bank. If an enterprise sends a single register, and accordingly, the entire amount under the document is debited from the current account at once, then it is more correct to formalize such a payment through account 76.

Attention! If, according to the register, the bank generates a separate payment slip for each person, then the payment can be directly deposited into account 51. You should also not forget about the commission that the bank charges for such operations.

Payment of compensation for delay

The law establishes that if an employer delays payment of wages, he is obliged to independently calculate and pay compensation to employees for this event. Such a payment is not subject to taxes, but social contributions must be charged on it.

Refund of salary

The return of excess wages issued can be made on the voluntary initiative of the employee himself personally to the cash desk or to an account, or it can be withheld by the organization from the salary of subsequent periods based on a written application.

| Debit | Credit | Operation designation |

| Voluntary return | ||

| 20, 23, 25, 26 | 70 | |

| 70 | 68 | Personal income tax withheld |

| 70 | 50, 51 | Issued in cash or non-cash |

| 26 | 70 | REVERSE - salary amount adjusted |

| 70 | 68 | STORNO - personal income tax adjusted |

| 73 | 70 | Overpaid wages highlighted |

| 50, 51 | 73 | Excess salary is returned to the cash desk or account |

| Employer retention | ||

| 20, 23, 25, 26 | 70 | Salary accrued |

| 70 | 68 | Personal income tax withheld |

| 70 | 73 | Excess amounts withheld from wages |

| 70 | 50, 51 | The balance of the salary was issued in cash or by bank transfer |

You might be interested in:

Chart of accounts for 2019 with explanations and entries

Salary deductions

All deductions can be divided into mandatory and voluntary. Mandatory tax includes personal income tax, deductions on writs of execution and similar documents. Voluntary deductions are those that are made with the consent of the employee on the basis of an application submitted by him.

Payment of financial assistance

Financial assistance is a payment to an employee at the expense of the organization’s profits. If its amount is less than 4,000 rubles, then personal income tax is not withheld from such payment.

| Debit | Credit | Operation designation |

| 84 | 73 | Calculation of financial assistance to an employee |

| 84 | 76 | Accrual of assistance to a person who is not an employee (relative, etc.) |

| 73, 76 | 68 | Personal income tax has been withheld (if the assistance is more than 4,000 rubles) |

| 73, 76 | 50/1 | Financial assistance was issued from the cash register |

| 73, 76 | 51 | Financial assistance was transferred from the current account |

| 84 | 69 | Contributions for financial assistance have been accrued |

Sick leave

The generation of sick leave payments depends on whether the region is participating in the direct payment project. In this case, the organization accrues and shows in accounting only that part of the sick leave that comes from its funds.

| Debit | Credit | Operation designation |

| 20, 23, 25, 26 | 70 | Sick leave accrued for 3 days at the expense of the organization |

| 69 | 70 | Sick leave accrued at the expense of social insurance (for regions not participating in direct payments) |

| 70 | 68 | Personal income tax withheld from sick leave |

| 70 | 50, 51 | Sick leave issued in cash or transferred through a bank |

Vacation pay

According to the Labor Code, each employee has the right to a period if he has worked a certain amount of time. The reflection of such a period in accounting depends on whether the company creates a vacation reserve. In addition, if the vacation period falls within two months, payment for the next month is charged to deferred expenses.

| Debit | Credit | Operation designation |

| Using reserve | ||

| 20 | 96 | A vacation reserve has been created |

| 96 | 70 | Vacation accrued to employee |

| 96 | 69 | |

| 70 | 68 | Personal income tax withheld |

| 70 | 50/1, 51 | |

| Without using reserve | ||

| 20, 23, 25, 26 | 70 | The current month's vacation has been accrued |

| 97 | 70 | Vacation accrual has been made for the next month. |

| 20, 23, 25, 26 | 69 | Contributions to social funds for vacation have been accrued |

| 97 | 69 | Contributions to social funds have been accrued for vacations that fall in the next month |

| 70 | 68 | Personal income tax withheld |

| 70 | 50/1, 51 | Vacation pay has been paid |

Payment of wages in kind

The law allows part of the employee’s salary to be paid in kind. However, this amount cannot exceed 20% of the total salary accrual. As a payment for earnings, property can be issued that can be used by the employee or be of benefit.

| Debit | Credit | Operation designation |

| 70 | 90/1 | The employee was given a salary in kind |

| 90/2 | 43, 41 | The cost of goods issued as wages has been written off |

| 70 | 91/1 | Other property was issued as salary (materials, fixed assets, etc.) |

| 91/2 | 01, 08, 10 | The value of property issued as salary has been written off |

| 02 | 01 | Depreciation on fixed assets transferred as salary payment was written off |

Important! It is prohibited to issue alcoholic beverages, narcotic or toxic substances, weapons and ammunition, or promissory notes as payment.

The chart of accounts and instructions for its use for accounting for all payments made by the organization to its employees are provided.

Maintaining salary on account 70

It takes into account all settlements with personnel:

- on wages, including basic and additional wages, as well as incentive and compensation payments;

- on, benefits and compensations;

- for payment of vacation pay and compensation for unused vacation;

- on deductions from wages to compensate for losses from marriage, shortages, theft, damage to material assets, etc.;

- on payment by employees of trade union dues, utilities and other services;

- based on a court decision, etc.

By credit, the entries in account 70 display the amount of debt of the enterprise/organization to the employee, by debit - the reduction of such debt due to the payment of wages or other amounts due to employees in accordance with the law, or the occurrence of debt by the employee to the enterprise.

Analytical accounts for account 70 can be opened for groups of employees (by divisions) and for each employee separately.

The main corresponding accounts to account 70 when calculating salaries are determined by the type of activity of the enterprise (organization):

- in production – (for workers in main production), (for workers in auxiliary production), 25 (for workers involved in the management and maintenance of workshops and/or sections), 26 (for employees of plant management and specialists), 29 (for workers in service production and farms);

- in trade and service sector - .

When calculating benefits, accounts intended for settlements with extra-budgetary funds are used (). When calculating vacation pay and amounts of remuneration for long service, it is used, etc.

All listed accruals are made on the debit of the indicated accounts and on the credit of account 70.

See step-by-step instructions for calculating and paying salaries in 1C 8.3:

Postings: wages accrued

Basic payroll calculations:

| Account Dt | Kt account | Wiring description | Transaction amount | A document base |

| 20 (23, 25, 26, 29) | 70 | Posting: wages accrued to employees of the main production (auxiliary, maintenance, management and maintenance workers of workshops and the enterprise as a whole) | 150000 | Help-calculation |

| 44 | 70 | Salaries accrued to employees of a trade or service enterprise | 60000 | Help-calculation |

| 69 | 70 | (due to illness, work injury, pregnancy and childbirth, etc.) | 20000 | Help-calculation |

| 91 | 70 | Wages accrued to employees engaged in activities not related to the usual for the enterprise (for example, maintenance of leased facilities) | 30000 | Help, calculation, lease agreement |

| 96 | 70 | Payments to employees are accrued from the reserve for upcoming expenses and payments (vacation pay, long service benefits, etc.) | 40000 | Help-calculation |

| 97 | 70 | Wages were accrued to employees engaged in work classified as deferred expenses (development and testing of new products, scientific research, market research, etc.) | 35000 | |

| 99 | 70 | Salaries have been accrued to employees of the enterprise involved in eliminating the consequences of emergencies, disasters, accidents, natural disasters, etc. | 15000 | Certificate of calculation, certificate of completion of work |

An enterprise (organization), in the event of a shortage of funds, can partially pay employees in kind, but such payments should not exceed 20% of the accrued amount of wages. When paying for labor with products of own production, it is taken into account at market prices in accordance with Art. 40 Tax Code of the Russian Federation. Personal income tax and unified social tax on payments to employees in kind are paid on a general basis based on the market value of products or other material assets issued to employees.

How to display payment of wages, taxes and deductions in transactions

These postings are reflected in the debit of account 70 and the credit of the corresponding accounts. They show a decrease in the organization's wage debt to employees.

| Account Dt | Kt account | Wiring description | Transaction amount | A document base |

| 70 | 50 | Posting for issuance from the payroll office | 254500 | Payroll, cash order |

| 70 | 51 | Salaries were transferred to employees' bank accounts (bank cards) from the company's account | 50000 | Certificate of payment, payment order, agreement with the bank |

| 70 | 68.01 | Personal income tax withheld from employee salaries | 45500 | Help-calculation |

| 70 | 71 | The amount previously not returned by him, issued on account, was withheld from the employee’s salary | 2500 | Employee advance report |

| 70 | 73 | The amount of compensation for material damage caused by him was withheld from the employee | 5500 | |

| 70 | 75 | Purchase of company shares by employees as payment for wages | 20000 | Statements from employees, decision of the general meeting of shareholders |

| 70 | 76 | Deductions from employees' salaries in favor of third parties (membership and insurance fees, alimony, repayment of utility bills, other payments by court decision, etc.) | 10000 | Help-calculation |

| 70 | 94 | The amount of material damage was withheld from the identified culprits | 5000 | Internal investigation report, order for damages |

In accordance with the Labor Code of the Russian Federation, the employer is obliged to pay wages at least twice a month. The advance amount should not be less than the salary or tariff rates for the first half of the month worked. The advance payment scheme is shown in Fig. 1.

Rice. 1. Procedure and timing of advance payment.

Deductions from wages can be made only in cases provided for by law. Art. 138 of the Labor Code of the Russian Federation establishes restrictions on the amount of deductions from wages:

- in standard cases – no more than 20% of the salary amount;

- in special cases provided for by law, as well as when deducting from an employee’s earnings under several executive documents - no more than 50% of the salary;

- when an employee serves correctional labor, pays alimony for minor children, or compensates for damage as a result of a crime - no more than 70% of the salary.

ATTENTION: similar article on 1C ZUP 2.5 -

✅

✅

The document is intended to contain information on accruals for all employees, deductions and calculated taxes and contributions at the end of the month. The document is created for each month once, after all charges, contributions and taxes have been calculated. Thus, this document must be entered after the document has been calculated for all employees.

Let me remind you that I continue to consider this issue on the basis of the information base that was formed following the results. We had payroll for October for three employees: according to Sidorov - payment at an hourly rate and a bonus; according to Ivanov - payment according to salary and he also had sick leave; according to Petrov - payment according to salary and work on days off.

Let's create a document Reflection of salaries in accounting(Section Salary – Reflection of salary in accounting) and click on the button Fill.

Rows are created for each employee in the tabular section. According to Ivanov: the first line is Payment according to salary. Next, the information about sick leave is divided into two lines: separately Expenses for Social Insurance Fund and Expenses at the expense of the employer. The accrual for employee Petrov is also divided into two lines: Payment based on salary and Payment for work on weekends. For employee Sidorov, accrual: Payment at an hourly rate and Bonus.

I would like to draw your attention to the fact that in this table section the Reflection Method column is not filled in. It is on the basis of the information in this column that it is determined which accounts will be reflected in this or that accrual. This will become more clear when we begin to consider this document on the side of the accounting program a little lower.

Let's decide how to configure the program so that the Reflection Method column is filled in. The most important setting is located in the organization information. Section Settings – Organization details.

Go to the Accounting policies and other settings tab – Accounting and salary payment. I talk in more detail about all other program settings in the article

Here, for the entire organization, we can define the reflection method that will be applied to the employees of the entire organization. The choice is made from the directory of the same name Ways to reflect wages in accounting.

In our database, a directory element called “26-70” was created, which will tell us that later on the side of the accounting program we will link account 26 to this method of reflection. On the side of the salary program, the account is not specified, since the chart of accounts is in 1SZUP 3.1- No. It is on the side of the accounting program. Therefore, here we should set only the name of the reflection method, but such a name by which we can understand which account, perhaps which analytics, will be tied to this method of reflection on the side of the accounting program.

We choose a way to reflect “26-70” for the organization as a whole. We point out that this method of reflection will be in effect from October 2016, since we keep records in the database from this month. Click Save and close.

After we have saved the change in this directory, let's go to the document Reflection of salaries in accounting and refill it.

For all employees, the Reflection Method “26-70” was filled in. It is not included only for sick leave accruals at the expense of the Social Insurance Fund. The program sees that this accrual is due to the Social Insurance Fund and on the side of the accounting program the posting Debit account is automatically entered. 69.01 Credit account 70.

In addition to accrued amounts, this document contains information about accrued contributions.

Information about insurance premiums is also taken from the document Calculation of salaries and contributions. Contributions will be reflected in the same accounting method that was determined for the accrued amount from which these contributions are calculated. Therefore, accruals and contributions are presented in one tab of the document “Reflection of salaries in accounting.”

This document also contains the Accrued Personal Income Tax tab. Let's move on to it.

On this tab, the program collects personal income tax for employees per month. In the accounting program, based on the information provided, transactions will be generated for the personal income tax calculated for the month. You can read in detail about accounting for calculated, withheld and transferred personal income tax.

Now let's talk about reflecting deductions. In the document Calculation of salaries and contributions we had two holds.

We are talking about deduction under a writ of execution and deduction for cellular communications. These deductions were reflected in the tab Withheld salary document Reflection of salaries in accounting

On this tab there is no such thing as a reflection method. Posting will be determined based on Type of operation. For alimony, the program automatically entered the type of operation. The program also substituted its own type of operation for the deduction for cellular communications - . This happened because in the settings of the type of deduction we indicated that this deduction has the purpose of “Deduction for settlements of other transactions” and the type of operation Deduction for other transactions with employees(Section Settings – Deductions, where we created the type of deduction “Cellular connection deduction (over the limit)”).

The program saw this, and already in the document Reflection of salaries in accounting substituted the required type of operation. We will see what kind of posting is implied by the type of operation Retention for other transactions with employees on the side of the accounting program.

So, we have looked at all the document tabs Reflection of salaries in accounting. Now let's make our example a little more complicated.

Here we can specify the reflection method for a specific employee. Select the reflection method 20-70. This setting will take precedence over the setting in your organization details. The program will see that the employee’s card is configured with a reflection method when filling out the document Reflection of salaries in accounting For this employee, the reflection method 20-70 will be selected.

For the rest of the employees, we did not make such settings in their cards, so the reflection method that is indicated in general for the entire organization will be applied. In the next publication we will look in more detail at other similar settings and their priority, because... This is not the only place where you can customize the way you reflect. The reflection method can be configured at the accrual type level, at the level of some documents, in the Divisions directory and in some other sections of the program. All these settings have their own priority. But I will talk about this in a separate article.

Let's return to our topic. Let's review our document. Now the document is ready to be transferred to the accounting program.

Reflection of salaries in accounting in the 1C Accounting 3.0 program

✅ Seminar “Lifehacks for 1C ZUP 3.1”

Analysis of 15 life hacks for accounting in 1C ZUP 3.1:

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners:

Let's move on to the accounting program. Transferring a document Reflection of salaries in accounting produced during synchronization. I will not dwell in detail on setting up and performing synchronization, since I wrote about this in detail, and. But I will note that in 1C Accounting, just like in ZUP, there is a document log Reflection of salaries in accounting. This journal is synchronized with the journal in ZUP and a similar document is created here. The screenshot below shows the document Reflection of salaries in accounting, which was created in Accounting after synchronization.

Since we are performing the transfer for the first time, we should also further configure the reflection methods used. A window will open.

Select the reflection method 26-70 for editing. To do this, press the F2 button or right-click and call up the context menu. Choose Change.

On the salary side, we only specified the name of this method of reflection, but on the side of the accounting program we already have the opportunity to set an accounting account, which implies this method of reflection.

In this case, this method of reflection implies accounting account 26. We indicate the cost item - it will probably be Labor compensation. Save.

We do the same for the reflection method 20-70. We enter the accounting account 20.01 and the cost item - Labor remuneration. Let's limit ourselves to these settings.

Let's review the document. Let's open the wiring. Let's figure out what kind of wiring we got.

The first two lines for employee Sidorov - his salary and bonus were reflected on account 20, i.e. posting D-t 20 K-t 70.

Further, entries D-t 26 K-t 70 were generated for the remaining employees, i.e. This is the setting that we set for the organization as a whole (line 3 - 6). On the seventh construction site, we have a posting reflecting the fact that sick leave is being accrued at the expense of the Social Insurance Fund (Dt 69.01 Kt 70)

Lines 11 to 18 are entries relating to insurance premiums. Set 69 of the account means insurance premiums.

And the last two lines are data related to deductions. For employee Petrov, alimony, the program sees the type of operation Alimony and other writs of execution. It is written in the program code that this type of operation corresponds to the posting D-t 70 K-t 76.41 and it is automatically substituted. Concerning Deductions for other transactions with employees, then the program code states that this type of operation corresponds to the wiring D-t 70 K-t 73.03.

So, today we figured out why we need a document “Reflection of salaries in accounting”, what settings you should pay attention to before filling it out and how transactions are generated in the program 1C Accounting 3.0 based on this document, transferred from 1C ZUP 3.1. In the next publication I will talk in more detail about various settings for reflection methods and the priority of these settings on the side of the ZUP program.

In order to organize labor and wage accounting at an enterprise, the accounting policy specifies what forms of primary documents will be used for this purpose. At the same time, with the entry into force of the accounting law of December 6, 2011 No. 402-FZ, the use of unified forms ceased to be mandatory.

But many accountants, when organizing salary accounting, give preference to the forms of primary documents approved by Goskomstat Resolution No. 1 of January 5, 2004. The primary documentation for accounting for the movement of personnel are orders (on hiring, dismissal, transfers, provision of paid leave, etc.) . For each hired employee, a personal card is created and a personal account is opened.

Data on accrued and paid salaries, amounts of deductions and deductions are entered into a personal account, which is opened, as a rule, for a year. Data is transferred to personal cards from time sheets, sick leave sheets, orders for piece work, orders (on making deductions or calculating bonuses), etc.

You can learn about the procedure for organizing primary accounting at an enterprise from the article “Procedure for organizing primary accounting” .

Accounting for settlements with personnel for wages - account for accounting

To record calculations for remuneration of personnel, accounting account 70 is used - it summarizes the relevant information for each employee of the enterprise.

The debit of the account shows the amount of paid wages, as well as the amount of deductions (for taxes (account 68), for executive documents (account 76), shortages (account 73) and damage to valuables (account 94), etc.) . If an employee does not receive his accrued salary on time, then this amount is reflected in the debit of the account. 70 in correspondence with account. 76.

The loan displays:

- the amounts of accrued wages in correspondence with the accounts in which the corresponding costs are collected;

- amounts of accrued vacation pay in correspondence with the account. 96;

- accrued dividends to the company's employees in correspondence with the account. 84.

Enterprises must organize analytical accounting according to accounting 70 for each employee.

About the accounting register, which summarizes information on settlements with employees for wages, read the article

Features of the balance sheet for account 70 .

Accounting: payroll

Due to the fact that wage costs are reflected in the cost of production, wages are calculated according to the account. 70 in correspondence with accounts:

- 20 (23, 25, 26, 29) - for manufacturing enterprises (depending on the structural unit where the employee is employed);

- 44 - for trading enterprises.

Accounting: salaries to be issued

Accounting for wages and deductions from them should also clearly reflect the amount payable to employees. In this regard, accrued on the debit of the account. 70 wages will be reduced.

Personal income tax is necessarily withheld from the salaries of all employees - for this purpose, Dt 70 Kt 68 is posted.

Payment of wages (without personal income tax and deductions on writs of execution, etc.) is made through the cash register or by transferring funds to the employee’s card account. When issuing a salary account. 70 corresponds with account. 50 (51).

You can learn how salaries are transferred to a card in the article “Procedure for transferring salaries to a bank card” .

Accounting for payroll calculations - postings

In accordance with the chart of accounts, approved by order of the Ministry of Finance dated October 31, 2000 No. 94n, it is proposed to use such main entries from the account. 70:

- Dt 70 Kt 50-52, 55, 68-69, 71, 73, 76, 79, 94;

- Dt 08 20, 23, 25, 26, 28-29, 44, 69, 76, 79, 84, 91, 96-97, 99 Kt 70.

Accounting for labor and wages among simplifiers

Salary accounting for the OSN and simplified tax system is carried out in the same way, with the exception that not all simplifiers will be able to reduce their income by the amount of labor costs. This right is retained only for those simplifiers who have chosen the object of simplified taxation “income minus expenses”.

Results

For accounting of personnel remuneration, account 70 is used. It summarizes information about accrued wages, deductions and amounts to be paid.

To reflect payments or deductions accrued to employees in the “1C: Accounting 8 (rev. 2.0)” program, you must fill out the directories “Methods of reflecting salaries in accounting”, “Accruals of organizations” (types of calculation) and indicate the correct information in them.

Let's look at a few examples.

Reflection of salaries of production workers

Example: The enterprise has production, and the wages of production workers should be credited to account 20, with appropriate analytics.Actions in the program:

1. Information about accounting entries for accrued payments is contained in the reference book “Methods of reflecting wages in accounting” (menu “Salary - Information about accruals” or the “Salary” tab). By default, it has two values: “do not reflect in accounting” and “Reflect accruals by default” (account 26). To reflect wages on account 20, we will create a new reflection method, indicate the debit account: 20, and the analytics for this account. Credit account: 70. The “Type of accruals” requisite is used to include accruals in labor costs in accordance with Article 255 of the Tax Code of the Russian Federation.

2. Information on accruals assigned to employees is contained in the directory “Basic accruals” (“Accruals of organizations”, also called “types of calculation”). The directory is available through the “Salary - Information on accruals” menu or the “Salary” tab. By default, there is one accrual “Salary by day”. Let's create a new accrual; you can use copying. We indicate the created method of reflecting accruals to account 20. Next, it is important to correctly fill out the following details: type of personal income tax: 2000 (Remuneration for performing labor or other duties...), type of income for insurance premiums: Income entirely subject to insurance premiums.

3. In the “Hiring” (or “Personnel Transfer”) document, in the “Type of calculation” field for production workers, we will indicate the new accrual:

4. At the end of the month, we create the document “Calculation of salaries to employees.” When filling automatically, the types of calculations specified for employees are substituted:

5. We carry out the document “Calculation of salaries to employees.” Postings have been generated in Dt account 20, in accordance with the settings (the figure does not show data for all employees):

6. We create and implement the regulatory document “Calculation of taxes (contributions) from the payroll.” Contributions to the salaries of production workers will also be charged to account 20.

Reflection of the fine accrued to the employee

Example: The employee was assessed a fine, the amount was posted to account 73 “Calculations for compensation for material damage.”Actions in the program. Of course, you can reflect the fine by manual operation. But if such an accrual has to be done repeatedly, then it makes sense to enter information into the program to reflect it.

1. Create a new way to reflect wages “Fine”. Since this is a deduction, it will be posted to the debit of account 70 and the credit of 73.02. We do not indicate the type of accrual.

2. Create a new type of calculation (accrual) “Fine”. We do not fill in the type of income under personal income tax and the type of accrual under the tax code. However, the type of income for insurance premiums is required to be filled in, so we select “Income that is not subject to insurance premiums.” Specify the created reflection method:

3. At the end of the month, we create the document “Calculation of salaries to employees.” We manually add a line, indicating the employee, the type of calculation “Fine” and the amount:

4. We carry out the document “Calculation of salaries to employees.” The fine is reflected by posting Dt 70 Kt 73.02, in accordance with the settings:

Example: The employee was on sick leave and received temporary disability benefits. The first two days of sickness are paid for by the employer, costs are charged to account 26. Subsequent days of sickness are paid for at the expense of the Social Insurance Fund.

Actions in the program:

1. To reflect benefits from the Social Insurance Fund, we are creating a new way to reflect salaries. Debit account: 69.01 “Calculations for social insurance”, analytics: “Insurance expenses”. Loan account: 70, type of accrual is not filled in.

2. We create a new type of calculation (accrual) for benefits from the Social Insurance Fund. Specify the created reflection method. Type of income for personal income tax: 2300 (Temporary disability benefits), insurance contributions: “State compulsory social insurance benefits paid at the expense of the Social Insurance Fund.” We do not indicate the type of accrual under Article 255 of the Tax Code of the Russian Federation, since benefits are not included in wage costs.

3. A benefit for a bank account at the expense of the employer can be reflected in accounting using the “Default” method of reflecting expenses (account 26). But in order for payments to be correctly taken into account when calculating personal income tax and insurance premiums, it is necessary to create an accrual (type of calculation) and indicate the appropriate types of income. We create an accrual, indicate “Reflection of accruals by default”, type of income for personal income tax: 2300 (Temporary disability benefits). The benefit is not subject to insurance contributions, so we select “Income wholly not subject to insurance contributions, except for benefits at the expense of the Social Insurance Fund...”. We do not indicate the type of accrual under Article 255 of the Tax Code of the Russian Federation, since benefits are not included in wage costs.

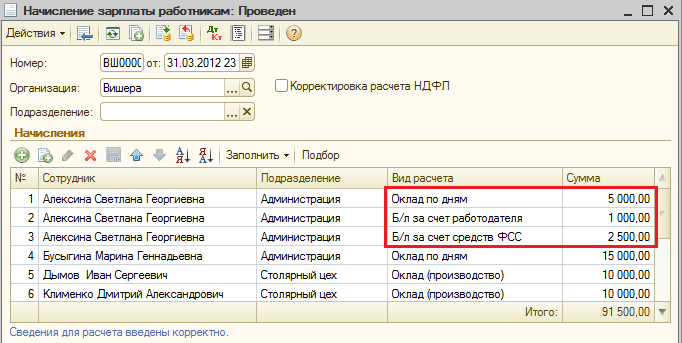

4. The 1C: Accounting program is not intended for calculation wages and other payments. Therefore, we calculate benefit amounts outside the program. At the end of the month, we create the document “Calculation of salaries to employees” in the program. We manually add lines in which we indicate the employee, the types of payment for payments at the expense of the employer and at the expense of the Social Insurance Fund, and the amount of benefits. We also change the amount of accrued salary for this employee, since salary is not paid during illness.

We carry out the document “Calculation of salaries to employees.” The amounts of salary and wages at the expense of the employer are charged to the account. 26, the amount b/l at the expense of the Social Insurance Fund - to the account. 69.01с subconto “Insurance expenses”, according to the settings:

In order for the payment of benefits at the expense of the Social Insurance Fund to be reflected in the accounting of insurance premiums, it is necessary to create and carry out a regulatory document “Calculation of taxes (contributions) from the payroll fund.” It generates not only accounting entries, but also movements in the tax and contribution registers, in particular, in the “Income Accounting for the Calculation of Insurance Premiums” register:

We will generate a report “Insurance Contribution Card” (menu “Salary - Accounting for personal income tax and taxes (contributions) from payroll” or the “Salary” tab). The card, in addition to the base for calculating contributions and the contributions themselves, reflects the non-taxable amount of benefits at the expense of the employer, as well as the amount of accrued benefits at the expense of the Social Insurance Fund.